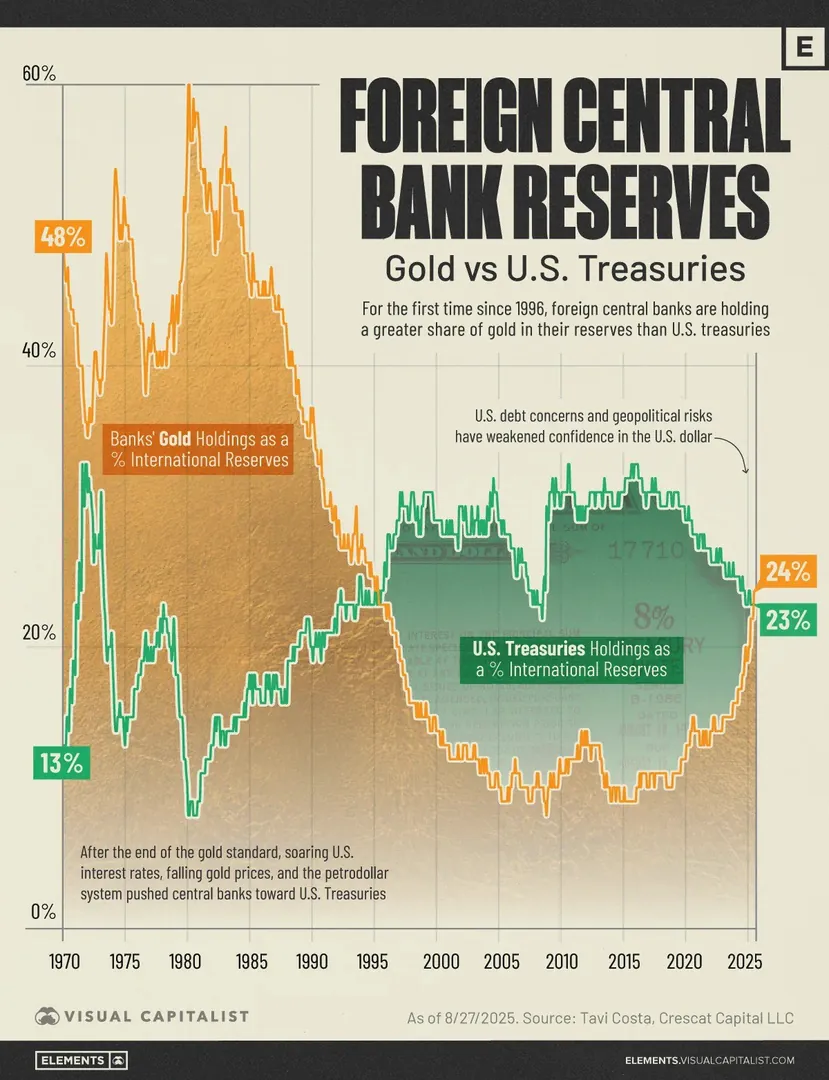

For the first time since 1996, global central banks now hold more gold in their reserves than US Treasury bonds. The share of gold in central bank reserves has doubled in the past decade, reaching 24%, while the portion of US Treasury bonds has decreased to 23% from over 30% a decade ago. This shift marks a notable change, driven largely by the rapid increase in gold prices, which has contributed to this new balance.

Despite this recent development, the current proportion of gold in central bank reserves remains far below the levels observed in the 1970s and 1980s when it peaked at 60%. This shift in holdings signifies a significant change in the composition of central bank reserves, highlighting the ongoing fluctuations in global economic trends and investment preferences.